Thursday, October 9, 2014

For Credit Card Debt Elimination, You Can Use A Debt Reduction/Negotiation

For Credit Card Debt Elimination, You Can Use A Debt Reduction/Negotiation

It is a good option to use a debt reduction or debt elimination company to eliminate your credit card debt.

The methods that these companies uses provides you with greater savings than traditional non profit debt consolidation programs.

This is because instead of negotiating only interest rates, the company negotiates reductions in the balances owed.

It is not uncommon for small businesses or consumers to save a lot of money on their debts. And, most people who enter this program are free from their debts within a relatively short period of time.

If you feel that this program may help you, we recommend that you get a free and confidential debt elimination plan.

Thursday, October 2, 2014

Thinking About Filing Chapter 11 Business Bankruptcy?

Thinking About Filing Chapter 11 Business Bankruptcy?

We recommend that you get free commercial debt consolidation advice to restructure your company's business debts.

Federal bankruptcy laws govern how

companies go out of business or recover from crippling debt. A bankrupt

company, the "debtor," might use Chapter 11 of the Bankruptcy Code to

"reorganize" its business and try to become profitable again. Management

continues to run the day-to-day business operations but all significant

business decisions must be approved by a bankruptcy court.

Under Chapter 7, the company stops all

operations and goes completely out of business. A trustee is appointed

to "liquidate" (sell) the company's assets and the money is used to pay

off the debt, which may include debts to creditors and investors.

In the commercial debt counseling

program, you are in control. Your assets such as inventory, bank

accounts, and equipment are protected from day one.

You decide how much you can afford on a monthly basis to put toward your creditors instead of a court-appointed trustee.

Creditors are prioritized and critical suppliers are kept providing the

materials that you need to keep your doors open and payments and

reductions are negotiated with the others.

We recommend that you get a free and expert commercial debt counseling to restructure your company's business debts.

Thursday, September 25, 2014

FREE Debt Reduction Plan

Debt negotiation is being used by thousands of people like you to honorably pay back an agreed-to, reduced amount to creditors. Debt negotiation is designed to help you with your debts in a shorter period of time than consumer credit counseling plans or just making minimum payments.

You can get a no-obligation FREE Custom Debt Reduction Plan from CuraDebt so you can find out how debt negotiation could help with a debt solution! Get A FREE Debt Reduction Plan

Debt Consolidation, Debt Negotiation, or Debt Settlement Help?

Get a free, no-obligation evaluation from a consumer recommended company, CuraDebt.

CuraDebt is a proud member of the Chamber of Commerce, RatePoint, D&B, TASC, IAPDA and has been rated as the #1 Debt Relief Company in the USA for 2 years running. See details on the website.

CuraDebt is a proud member of the Chamber of Commerce, RatePoint, D&B, TASC, IAPDA and has been rated as the #1 Debt Relief Company in the USA for 2 years running. See details on the website.

Thursday, September 18, 2014

Simple Ways to Save Money and Pay Off your Debts

Paying off your debts is incredibly challenging, especially now that we are living in a world that is getting increasingly expensive. The cost of living is rising quickly and we don’t seem to be making more money, so how can we possibly be expected to pay off our debts? Short of getting a new job that pays more, which is much easier said than done, is there any way we can change our everyday lives to create more money for ourselves to put towards our debts? There is.

It all starts with making simple, small changes to our lives to free up a dollar here, or a dollar there. These dollars will add up, and you can start to pay off your debts a bit faster. Once you get into a routine of saving money, it will become easier for you and this way of life will help you live debt free well into the future.

Below are a few simple ways that you can save a few dollars every day to put towards your debts.

- Making your own food. This is the biggest and easiest ways for you to change one aspect of your life and have it greatly affect your finances. While it may not seem like much, but eating out for one or two meals a day adds up incredibly fast, and you could be spending hundreds of extra dollars each day just feeding yourself.

By buying groceries and making meals at home, not only are you taking a healthier route but you are also saving money. You can take your leftovers for lunch as well, saving your more money! You can easily get into a routine of making your own meals and you would not believe how much money this actually saves you.

- Make a budget. A lot of people overlook the simple task of making a budget but you would be surprised with what you learn when everything is down on paper. When you write down all your monthly expenses, you can easily see what you are spending a lot on. Sometimes, what seems like a little, is really a lot and once you can see for yourself, you can start to make a plan as to how to decrease spending in a specific area.

- Organize your house and sell things you don’t need. You would be surprised as to how much stuff you are holding that you aren’t using. As they say, one man’s junk is another man’s treasure. Take a day to go through your house and be brutally honest about what you need and what you don’t, and you should be finding quite a few things that you are able to sell either online, through a local forum or even at a garage sale! You will also get the added bonus of the feeling of reducing clutter in your house – what a relief!

These are just a few ways that you can simply and easily reduce your debt by decreasing your spending in other areas of your life. If you are even more serious about finding new ways to pay off your debt, consider talking to a debt specialist and they can take a look at your situation and give you their ideas on what you can be doing to improve the financial aspects of your life. Money Mart

Thursday, September 11, 2014

How can a debt relief company help

In today’s society where buy now and pay later seems to be the way to go, you can become trapped under a pile debt and soon find out that you are overextended. A heap of unmanageable debt is staring you in the face and you are on the verge of bankruptcy.

Debt is commonplace in the world today.

Usually caused by the over use of credit cards, it’s too easy to fall

into the trap of not being able to make ends meet. Before you know it,

you can owe money to everyone and can barely remember what bill to pay

first. Skipping payments and collection calls soon become the norm. It’s

important to get a grip on your finances, seek relief from overwhelming

debt and breathe again.

A debt relief service can help with some

of the burden. You are still required to pay the debts you owe, debt

relief management can simplify the process by making one payment a

month, and lowering the interest rate. Debt settlement is another

option. The debt relief company will contact your creditors, negotiate

on your behalf for repayment of your debts and come to an equitable

agreement for both parties.

Debt relief services charge a monthly

fee to service your account. You should know that the cost of the

service varies taking in the total amount of the debt, the number of

creditors involved and the laws of the state in which you reside. The

laws in each state can be different. Debt settlements are unique to each

participant and the debt management company will tailor a repayment

program to your own situation.

It is important not to fall back into

debt after completing debt consolidation. Credit counseling may be

necessary to make sure you are on the right path. Counseling and other

tools are provided to help you maintain your financial health.

Counselors are available to keep you on the right path.

When you have had enough and are begin

searching for a debt relief company, be sure to do your homework. There

are some excellent debt management companies, but there are some that do

not do what they promise. Research the companies and compare the

services that they provide. It is advisable to check if they are

registered with the better business bureau and to read reviews from

customers. Debt relief can help you become financially healthy again.

Thursday, September 4, 2014

Consumer Credit Card Debt Relief Scams! Are They Real?

There are many companies that can help consumers with credit card debt relief. However, if you need to use one of these companies it is very important to make sure that they are who they claim and are properly licensed with no unresolved complaints against them. It is very important to do your due diligence with companies such as this simply because of the huge numbers of scam artists in this industry.

For example, you may call or be called

by a credit card debt relief company. If they ask for money upfront,

this a sure sign that they are a scam and you should not do business

with them. A large number of credit card debt relief scams target people

with their services and do not do anything for the customer at all and

of the scams, they usually collect their fees upfront.

This often leaves customers worse off

than they were to begin with regardless of whether or not the customer

paid them anything upfront because precious time and possibly money that

could have been better utilized by the customer has been wasted. Some

will make wild claims to customers that the company simply cannot live

up to but those who find themselves in desperate situations may believe

scam companies.

Consumers seeking credit card debt relief can avoid scams by checking the company out thoroughly and making

sure there are no upfront fees. Non-profit companies are a very good

choice but it’s a good idea to check them out as well. A thorough check

could include checking with your state’s attorney general on the phone

or online and asking for referrals from trusted friends or family.

Ask questions of the company such as how long they’ve been in business, how many people they have helped get out of credit card debt, and how they get paid. Remember that legitimate credit card relief companies do not take money upfront, they are often paid through your repayments.

Ask questions of the company such as how long they’ve been in business, how many people they have helped get out of credit card debt, and how they get paid. Remember that legitimate credit card relief companies do not take money upfront, they are often paid through your repayments.

It is important to take BBB reviews and

information with a grain of salt as it is not uncommon for fraudulent

companies to use alias names with customers and give the BBB a

completely different company name. When customers complain, the BBB

never picks up the complaints because the customers were given a fake

name and not the actual company name. This happens across all industries

and credit card debt relief scam companies are unfortunately no

different. Learn from more than 166000 people how hey got out of debt?

Thursday, August 28, 2014

Debt Resolution For Credit Card Debt Relief! Can it Help?

If you have a large amount of credit card debt and are looking to resolve some of it there are many programs out there that say they can help. However, the question is whether they actually can. In many cases yes these debt resolution programs can reduce your monthly payments by a considerable amount and they probably will save you some money in the long run as well. These amounts they save you will not be the large numbers that they advertise but they will definitely help take a small chunk out of some of the debt.

Debt resolution involves a company

talking to your creditors in order to settle your debt into one lump

sum. The more debt and creditors you have the harder it will be to get a

better rate, but with their negotiating skills they can definitely be a

help. Once it is in a lump sum they will ask you to pay a minimum fee

every month in order to diminish the debt slowly.

There will still be an

interest rate but it will not be higher than the ones you were already

paying on your credit cards. The companies that offer these debt

resolution programs will also tell you to stop paying your other

creditors their monthly fee. This way all the money can go towards the

lump sum.

Using a company to settle your debt also

has its risks as well. Some of them will require you to deposit money

into a savings account for up to 48 months before they will settle any

of your debts. Many clients drop out because they cannot make the

payments and therefor lose all the benefits of this program and even

more.

Another reason is that the creditors that you have signed a

contract with have no obligation to talk to and negotiate with a debt

resolution company. Most of them will if they think it is the only way

they will get paid though. Using debt resolution can also negatively

impact your credit score as well due to the stoppage of monthly payments

and the restructuring of the interest rate.

Debt resolution is only a good idea for

those who are in dire need of debt relief and it may negatively impact

those who aren’t. Make sure to follow the contract deadlines and

remember to not get into debt the next time!

Thursday, August 21, 2014

What is a debt consolidation loan

Following the 2008 economic downturn,

many people who formerly had good credit and a strong history of paying

their debts on time found problems in making regular payments. What many

of these people found as they missed payments for credit card and

mortgage debt was the interest rate used for their credit cards began to

rise as they missed payments or exceeded their credit limit. In turn,

this caused their credit score to drop and a large amount of ensuing

problems began, such as difficulties with finding employment and future

loans with a bad credit history.

Many people decided to take advantage of

a debt consolidation loan in a bid to minimize the impact of credit

card and secured loan debts, which made it a little easier to make

monthly payments and reduce the principal amount of a loan. Debt consolidation loans are available to most people and are used to reduce

the number of payments made each month on a variety of debts.

A

financial company will pay off the majority of debts owed by an

individual to credit card companies, auto loan companies and to banks or

credit unions. In return, the debt consolidation loan used to pay off

the debts is calculated and the consumer makes monthly payments to the

debt consolidation loan company to pay off their debts over a specified

period of time.

Although the majority of debt

consolidation loans are offered at a higher interest rate than

conventional secured loans, these loans are popular as they offer a

single payment that does go someway to paying off a number of debts in a

single shot each month. One of the major problems the majority of

people struggling with debt have when attempting to pay off credit card

and student loan debt is how to make more than the minimum payment each

month. In most cases, the minimum payment simply pays off some of the

interest gained over the preceding month.

A debt consolidation loan should be

investigated before making any decision on whether to use this method to

get out of a high level of debt owed to many different creditors. Using

a debt consolidation loan can be a good way for many people to find a

way out of crippling debt and begin to turn around their finances to

return to good credit and reduce their monthly bills. It is important to

ensure the monthly payment made towards repaying a debt consolidation

loan is within the monthly budget of the person repaying the loan.

Debt Consolidation Loan

Thursday, August 14, 2014

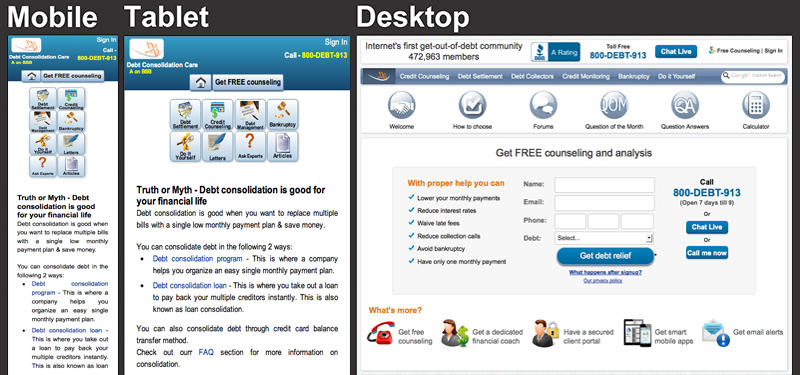

DebtCC architecture becomes user friendly with responsive theme

Debt Consolidation Care (DebtCC) Community takes a step forward to make the online experience of the consumers more pleasant, especially while checking the website with the use of multiple devices starting from a smartphone to a tab. The modern technology has improved our lives in all aspects over the years. Most online communities like

Debt Consolidation Care have benefited from modern technology helps them to be updated and be more efficient in helping the visitors of the website. Debtcc is on the process of developing into a responsive design. It can help to enable the consumers to open the website from multiple devices and from different places without interruption.

DebtCC attempt is to represent the website to their valuable visitors accessing the website from different devices. One of the most important questions that Debtcc considers now is how responsive structure can help to make the online visitors experience better while opening the website from different devices.

What is Responsive Architecture?

Responsive design is a web design as well as a development technique that creates a website, which changes in accordance with the size of a user’s screen. Responsive architecture optimizes a user’s browsing experience. So, DebtCC focuses on to create a flexible and responsive web page giving priority to the comfort of the different users accessing from different devices.What is the reason behind shifting to responsive design?

Debtcc can deliver quality content to their visitors using different devices. The offline browsing capabilities of HTML5 mean that the websites can be easily accessed with the tip of the finger. Traditional visitors will be re-directed to a device specific website. Well, a website using a responsive design structure one website can be used in different devices.How responsive structure changes to fit the screen?

What are the benefits of responsive structure system?

There are several benefits of a responsive structure system that helps in updating the website with ease. It can be easier for the visitors to search the website online. So hopefully, we’ll be able to solve their problem immediately.We are working on the website and continuously modifying it to represent it in a better way for an excellent user’s experience. In this form of structure, changes are made only once and the website will be compatible with all the browsing devices.

We are working on the website so that the visitors are not required to open the website from the sub-domain eg., m.debtconnsolidationcare.com. Once we shift to the responsive structure theme, the visitors can open the website from different devices by using the same url used for desktop version i.e,, debtconsolidationcare.com.

Conclusion:

DebtCC always attempts to stay ahead of the trend and tries to

deliver best to its online visitors. It is switching to responsive

structure keeping its different device users in consideration.

Responsive theme has a clear advantage over mobile theme and the

community is changing for the better. Under Debt Problems?

Thursday, August 7, 2014

5 Financial tips

Tip no 1: Set clear goals instead of making flimsy resolutions to make life bigger and better

Resolutions are just fragments of your imagination. They are not concrete and hardly do any good to you. You make plenty of resolutions at the beginning of your career and then forget them within a few weeks. Set clear goals for your life. The goals are specific, realistic and they do have a deadline.

The deadline induces you to give your best effort. For instance, if your goal is to pay off debt by the end of 2014, then you'll start taking measures to pay down your debts within the next 11-12 months. You'll look for ways to pay back your creditors and strengthen your finances.

Tip no 2: Understand that you've achieved financial freedom when you can give plenty of money to your family without any worry.

You've achieved financial freedom truly when you can give loads of money to your family without any anxiety. Your family will have various kinds of financial requirements from time to time. If you can meet various monetary requirements of your family without worrying about your savings, then it means you've gained financial independence in the truest term of the word.

Tip no 3: Watch out for happy hours at restaurants and cheaper cellphone plans to save money in 2014.

Several restaurants organize Happy Hour events at restaurants. You can save a lot of money on drinks, food and other things if you go at restaurants during the Happy Hours. All you need to do is check out if the good restaurants are offering Happy Hour events to people. You can even drop in the idea of organizing Happy Hour meals at your favorite restaurants. This will help you avoid exhausting your entire paycheck when you've meals at restaurants with your friends and family.

The cost of the cellphone plans has increased a lot in the past few years. It is not rare to spend around $100 (every month) on the cellphone bills. This amount of money can eclipse the cost of other utility bills as well. Negotiate with your customer service representatives for a cheaper cell phone bill in this year so that you can pay less and save money in 2014.

Tip no 4: Taking wedding vows without checking your partner's credit report is like committing financial suicide. Be little unromantic if you love yourself.

It's certainly not romantic to ask your spouse show his/her credit report. However, life is not all about love and romances. You may not be able to buy a house just because your spouse's credit score is terrible due to overwhelming debt. You need to check the credit report of your spouse for your own financial well-being. Check out the financial health of a person before walking down the aisle since you would never want to get into unnecessary financial troubles later.

It may happen that your spouse may want to review your credit report too. Show your credit report to him/her. Discuss both of your strengths and weakness so that both of you can work accordingly and have a brighter financial future.

Tip no 5: Bring a piggybank into your house and throw away new loan application forms in 2014.

Buy a piggybank and keep it in your house to build your emergency fund. Buy a cute piggybank and keep a certain amount inside it everyday. You can give this piggybank to your kid as the New Year gift. Ask your kid to save whatever he/she can every day or every week. This will help your kid develop the habit of saving from a tender age in a fun way.

Avoid taking out fresh loans if you don't have any intention to increase your debt-to-income ratio in 2014. Don't borrow unless you have no other way to arrange money. Learn from more than 166000 people how hey got out of debt?

Thursday, July 31, 2014

Inter-page communication: Forum creates an opportunity for the newbies to get rewards

Did you ever think that posting as a registered member in the DebtCC forum can help you win rewards? Yes, it’s true. DebtCC is giving an opportunity to the people to register themselves with the forum and helping them to win rewards while asking questions.

You may think why the forum prefers you to post the question as a member. Well, the simple answer to this query is that DebtCC doesn’t think only about itself but it believes in walking with the people and helping them as much as possible. One of the main purposes of introducing the concept of inter-page communication is to increase the participation in the community.

Once you’re a registered member of the community, you can accumulate points and easily earn while asking questions. Another advantage of being a registered user is that it will be easier for you to follow up with the community experts’ reply, as you’ll get notification mail. You’ve another opportunity to win cash reward by participating in monthly contest. If you subscribe to the newsletter, then you can be aware of the latest news in the industry.

In order to register, you’ve to click on the “want to join now” button and submit it. Once you submit, you’ll find a pop up box. You just need to provide your email address and screen name, after completing the process you’re a registered member of DebtCC.

However, if you choose to ignore the chance of winning cash rewards, you can click on “Not Now” button and it will redirect you to the “post a new thread” page.

As a matter of fact, the community’s sole intention is to help people make some extra money by joining as a member as well as guide them out of debt. Under Debt Problems?

Thursday, July 24, 2014

5 Financial tips for the last week

Tip no 1: Simply say no to your friends when they force you to have a meal at an expensive restaurant. Make smart excuses when your friends force you to have meals at costly restaurants. If your financial situation is bad and you need to save money, then stop going to pricey restaurants. In case you're tired of making excuses, then state the fact to your friends.

Don't feel shy as it won't help you to save money. Real friends will understand your situation and cooperate with you. Others will laugh at your back for a few days and then forget the matter completely.

Tip no 2: Debt settlement is just like a business. So, take the emotion out and be practical. Be strong and practical when you're negotiating with creditors to settle debts. Don't be ashamed to reveal your true financial situation to creditors. Don't feel guilty because you couldn't pay your bills on time. Banks are well aware of the fact that a certain number of creditors won't be able to pay debts on time.

If you feel too much guilty, then creditors will just take advantage of your situation and try to grab a meaty deal. Be bold, strong, polite and resolute. Negotiate smartly so that you can get out of debt by paying only a fraction of what you owe to your creditors.

Tip no 3: Give up the temptation to have movie theater foods to cut down expenses and save money. Who doesn't like to watch to munch delicious foods while watching movies? Everyone does, but you've to pay a good amount for having snacks and drinks. The cost of the movie theater foods is almost as much as the movie tickets. Instead of spending a sizable amount upon movie theater foods, bring your own snacks discreetly and eat them while watching the movie.

If you have kids who love to eat movie theater foods, then feed them well before heading to the cinema.

Tip no 4: Read money saving blogs to get fresh ideas on how to thrive on a frugal lifestyle. The web world is flooded with blogs on frugality and different ways to save money. If your financial life is not going well due to bad spending habits, then just type "blogs on frugality" or just plain "frugal tips" in a popular search engine box. You'll get hundreds of blogs on frugal living tips and ideas. Just go through the blogs and get some tips on how to thrive on a frugal lifestyle.

If you need more inspiration, then just buy books on money-saving tips and strategies. Read the book in your free time and follow the tips in your real life.

Tip no 5: A judgment can make you go through hell for several years. Be wise and pay it off quickly. A judgment can create significant problems in your life. Creditors will start garnishing your wages once judgment is issued against you. They'll levy your bank account and debit money till the judgment is paid in full.

Apart from wage garnishment, judgment may pose problems when you're trying to obtain a credit card or a rental apartment. Judgment stays on your credit report for 7 years. Lenders check your credit report before approving your loan or credit card application. They'll be skeptical to lend you money after seeing that judgment has been updated on your credit report. Debt Consolidation Loan

Thursday, July 17, 2014

What Is Debt Settlement?

Debt settlement is an agreement between a consumer (or business) and a creditor where the creditor agrees to accept less than the full balance as satisfaction of the debt. Sometimes this type of transaction is also referred to as a “settlement in full,” since the revised agreement fully satisfies the entire balance on the account.

For example, if you owe ABC Bank $10,000 and negotiate a 35% settlement, that means you would pay the creditor only $3,500. What happens to the remaining $6,500? It gets canceled (i.e., forgiven) by the creditor, and of course this represents a loss of that amount to the bank.

When people first hear about settlements, they immediately think, “That sounds too good to be true. Why would a bank want to accept a loss like that? Won’t they just automatically file a lawsuit against me for the full amount?”

The truth is that it’s the *banks* themselves that want to settle. The reason they do this is not because they want to show mercy or kindness! It’s a straightforward financial decision. The big banks have calculated that the farther behind an account gets, the greater the risk they will never recover anything at all. The person may have lost their job and have no income, so there are no wages to go after.

Or they may have recently lost a property to foreclosure and now the creditor has trouble locating the person after they’ve moved to another state. In many cases, people just file bankruptcy to take care of their debt problems. Under Chapter 7 bankruptcy, the creditor will receive nothing on the claim – zero!

Under Chapter 13, they will receive some amount back, but they have no control over how much since that is determined by the court (based on the debtor’s ability to make payments). And most Ch. 13 plans last for five years, so it takes a very long time for the creditor to get paid that way.

Instead of taking a chance on collecting zero, or collection a small fraction of the balance over five years, most banks would rather cut their losses and resolve the account. This is the rationale behind the banks’ motivation to settle. It helps them reduce the loss they would otherwise be risking. Every major creditor has their own individual policy on such settlements. Some are more difficult than others to achieve settlements with, but it’s common to see debts settled for 35-40% of the balance, and settlements of 20-30% are quite common with some creditors.

In my professional opinion, debt settlement is a very good strategy to consider if you wish to avoid bankruptcy, especially if you are not eligible for Chapter 7 (where all the debts go away) and have to file under Chapter 13. Instead of a 5-year path to recovery, while you are under the financial supervision of the court the whole time, you can privately negotiate settlements and have a much faster path to recovery.

Debt settlement is not for everyone who is experiencing a financial crisis, but it’s certainly a viable and effective strategy in the right circumstances!

Successful Debt Settlement Clients Hundreds of success stories

ZipDebt has been in business for over a decade and has helped settle millions of dollars and debts with our clients. The hundreds of debt settlment success testimonials we have received are proof that ZipDebt's Do It Yourself debt settlement program really works!Tuesday, January 7, 2014

Debt Relief Program

Of all Debt Relief Programs, Debt Settlement, is the most desirable option and the least expensive way to get out of debt. A debt settlement program has professional debt negotiators working with your creditors to settle your debt.

Debts are negotiated in an orderly manner and agreements are reached with each of your creditors subject to your approval. The program takes about 12-36 months and is completed when all debts in the program have been settled,

Credit Counseling services keep in close touch with credit card companies and other lenders. Sometimes they can negotiate lower interest rates which will reduce your debt to a certain degree. Credit counseling may take five years, and does not provide as much savings as a quality debt settlement program can.

Another option is Debt Consolidation.

These loans combine all your current payments into one monthly payment. While the interest rates may be reduced, the payment term may be very long and gets you into new debt. This type of loan is less desirable and may be more risky if your home is used as collateral.

Personal Bankruptcy should always be a last resort, because the outcome is long-lasting. Since the new law was passed, most people will only qualify for Chapter 13, which typically represents a five-year repayment plan to the creditors. Bankruptcy will stay on your credit report for ten years, making it almost impossible to obtain new credit or buy a home.

Of all Debt Relief Program options mentioned above, Fast Track’s Debt Settlement Program works best for consumers in need of a way to settle their debts. We negotiate with your creditors and encourage them to accept a one-time, discounted settlement payment. The Fast Track program provides ethical and dedicated service to help you achieve your goals.

When we start your plan we establish an affordable monthly payment which is deposited in a settlement account in your name. Once you have the required funds in your settlement account, we will contact your creditors and make settlement offers.

We will continue to work with them until all debts in the plan have been settled. FastTrack’s goal is to settle all debts in the plan for a significant discount off the outstanding balance, Click Here to Get A Free Consultation,

Subscribe to:

Comments (Atom)